How to spot scam trading bots

Share

Introduction:

Call me cynical but whenever I come across an ad for a trading bot/trading group/gaming app/betting website/crypto coin or rewards/lottery website that promises to help me get rich, make money online or make crazy market beating returns to "escape the matrix" alarm bells go off in my mind immediately! My mind then gets flooded by a series of questions:

- Why is this person selling me a system to make money instead of using it to get rich themselves, retire in the south of France and busy themselves with the propagation of the species?

- If you make money in trading by taking money from someone else via information asymmetry, i.e. you know something that they don't due to which you end up taking their money as punishment, why is this person willing to spill the beans with me for a couple hundred bucks? How do I know that this course/membership is not cope for them having lost a lot of money in the markets from being a crappy trader due to which they are now trying to make up for the losses by selling "courses" aka compiled information that's freely available on the internet and which is ambiguous enough that if people can't use it to get rich or make money for themselves you can easily blame it on them for their own incompetence and throttle any further rebuttal by gaslighting them with fake reviews and screenshots to get them to back off by further feeding into the insecurities which made them purchase your course in the first place!?

- If this app/gaming website is giving me free money for doing the most mindless and ridiculous of things, then how can I be sure that this is not a Ponzi scheme that pays out these breadcrumbs in the beginning to get my hopes up and make me believe it's true so that I can become greedy and invest more into the platform only for them to then close down shop abruptly and run away with my life savings?

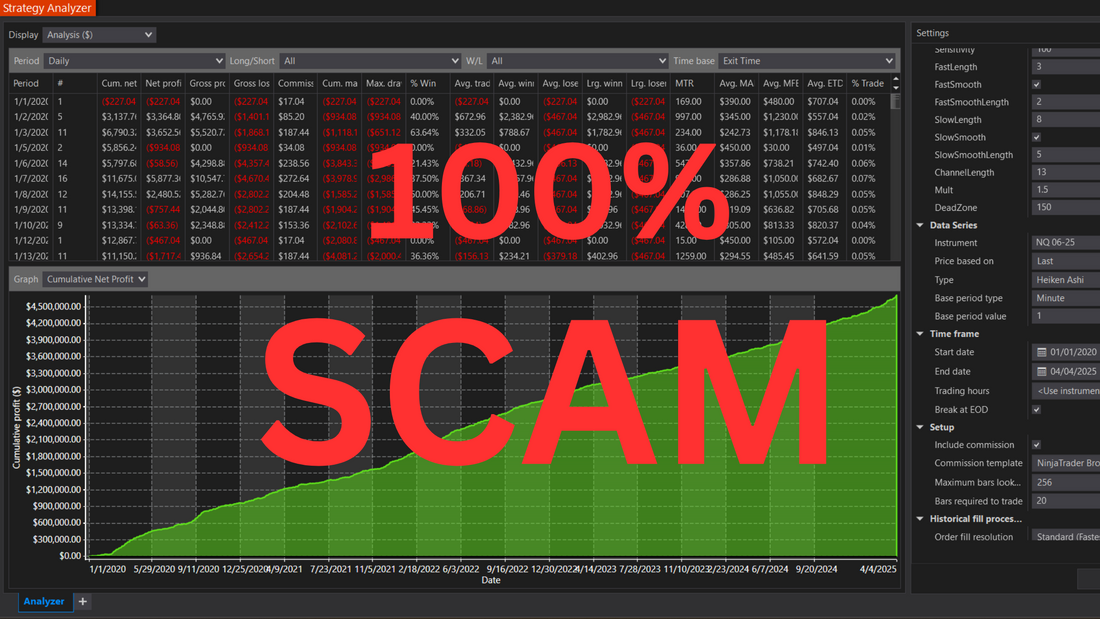

- If this trading bot is really so good and its beating everything out there in the market and you are showing screenshots, then firstly why broadcast it to the entire internet instead of being quiet with your discovery and selling it to a hedge fund for a high price? Moreover, how can I be sure that the screenshots are not fake or that the strategy didn't just overfit on the data or that you didn't just manually code in the trades to fool people into believing that this is a profitable strategy? Also where are the explainer videos, detailed walkthroughs and demos? If they exist, then why are you trying so hard to sell it to me? Are you really that desperate for more money despite clearly having so much? Something does not add up and how do I know you didn't hack or abuse the backtester to produce these feel-good results instead of coding things ethically? Although your strategy ticks all of the right boxes in theory, how do I know that your results are not biased by some hidden bug which will make the strategy perform in a completely different way in the live market and therefore make me lose ALL of my money!

In short, somewhere deep within my psyche there's a belief that there is no free lunch in this life and that everything costs something either directly or indirectly. I also believe that people are inherently selfish so if someone wants the best for me or approaches me with something that will genuinely help me out, my guards immediately go up and I start to look for the catch and the hidden transaction that's taking place and is the basis of all human relationships, after all even the selfless people who are saving starving kids or mute animals are getting a kick out of being a savior and/or divesting themselves of their inferiority complex by playing out a superior position via acts that looks purely selfless from the outside but are rooted in insecurities and a selfish desire to be seen in a certain way or feel like a certain kind of person.

So needless to say, it's ironic that I now find myself on the other side of the fence trying to sell trading bots to the entire world! Fate does have a sense of humor.

At one point in your journey life might force you to confront the very things that you are trying to escape, only to humble you and make you realize that life as a whole is really not about you and that you as an individual are really not all that special in the grand scheme of things. My previous line of reasoning is completely valid and has helped me protect myself and others from a bunch of scammers, shady characters and predators out there, however, at some point you realize that even if you can dodge all bullets to become exceptional yourself and beat everyone else at everything that matters, a majority of people will resonate more with the scammers than they will with you. Moreover, in a democratic society the idea that "might is right" is replaced by "the majority is right" whereby if you stand out, you essentially stick out and soon enough you will only fall victim to the tall poppy syndrome whereby the shady characters who you just dodged and exposed using your intellect will point their legions towards you and turn you into a symbol that encapsulates the latent hate and frustrations of their collective unconscious to turn you into "the enemy" who needs to be dealt with (lest they disenchant these drones out of the programming of their masters). In simple terms, people trust those who they can relate to and a cost of becoming exceptional is becoming unrelatable, in which case people will look up to you and adore you but will side with those most familiar to them to betray you at every corner out of sheer cowardice that's not even registered as such in their own minds.

This structure of society is what essentially forced me into the other side of the fence. I realized that if you become super rich and stand out alone in society as better than everyone else, you don't just stand out, you stick out and before you know it you will become a target! This can be mitigated by dumbing yourself down to make yourself more relatable via the traditional celebrity approach whereby the masses vicariously live through you due to which they probably wouldn't want your head on the pike or where you surround yourself with security, lawyers and all of these hired mercenaries that your wealth can afford only to have them be more loyal to your wealth than to you as a person, in which case it wouldn't be long before they serve a greater master and wouldn't think twice before throwing you under the bus.

As such, the problem of navigating through the social fabric and the realm of other people is a HUGE problem for me and Magic Money is my solution to that or at least a step in the right direction.

Sure, I can try to approach a Hedge Fund or private investor with the strategies and scale them behind the scenes but the cost for doing that is a loss of freedom and an entanglement with a million different legal leashes the end goal of which is to turn you into a glorified employee who is forced to report to shadow masters who are actively pulling your strings and regulating your behavior behind the scenes! On the flip side, painstakingly scaling all of these strategies myself to the level of wealth I want them to manage as well as attain for myself will take a long time if I am being honest because unlike many I didn't start off with money and literally had to go into debt and stake my last dollar to perfect these strategies.

So, on one level, scaling some of the more stable strategies with a limited number of clients and creating a community around this endeavor just makes sense as it affords me more freedom, helps me create a community around myself not of mercenaries but of peers who I helped grow into their positions of power and wealth from scratch and also helps me create a social shield against the drones without having to dumb myself down on camera or IRL in order to become "relatable". Launching this business also helps me move closer towards my highest purpose for this life which is to make planet Earth stable enough for the next step in human evolution by turning this inner circle that I am creating around Magic Money into a test group for the other breakthroughs and innovations that I am working on in order to create this post human infrastructure for a new kind of civilization that will subsume our existing one in preparation for this evolution.

This is the clear and honest truth about why I am selling you something that makes you more money than what you pay for it every single month/year. No lies or hype, just a clear transaction that's perfectly balanced on both sides by my selfish desire to get rich quicker with more freedom and your selfish desire to get the highest possible returns for your capital without lifting a finger or dealing with the years of pain, torment, account blowups, betrayals, debts, hacks, frustrations, heartbreaks, scars and being dragged through glass in general (metaphorically speaking) that's required to come up with the fully automated systems that can produce these stellar returns and continue to do so because of the manic obsessive intellect of the guy behind them!

So now that we are clear about the motivations and intentions behind this project let's jump into the more practical stuff around how exactly to identify a scam trading bot/trading bot scam because believe me there are some shady as hell characters with a twisted intellect and loose morals who have given this industry a notorious reputation and will do anything for a quick buck! During my years in the trading bot trenches I have come across plenty of them and in fact I actually started out my career by trusting an opensource TradingView strategy with my crypto because it showed amazing results in the backtester only to then lose all of my money and gain a newfound enemy who I have now surmounted for you in the process of building Magic Money.

The Scams

1. Give us your money! (custom platforms and software)

The first on the list is a scam so simple it baffles me that people actually fall of it! Usually someone creates a fake profile of an attractive girl (which is usually a stolen picture of an Instagram model) and then they message you first and try to build up rapport with you. They then gradually start to share screenshots of how much money they are making via this crypto trading bot their friend told them about. This is then followed by a link to a legitimate looking website where they request you to send some crypto/money to start seeing results for yourself. At first, they might even give you payouts to build up trust and prove that this system actually makes money, or they might create a UI where you can check in daily and see that your money has grown by a certain amount. All of this is meant to get your guards down and evoke greed in you so that you then deposit more of your crypto/money into their platform!

In reality no actual trading was happening behind the scenes to begin with! The payouts where them simply using funds they robbed from another user to pay you in order to get you hooked! Also, the results that they showed you were all fake and made-up numbers on the screen! Before you know it, they then suddenly pause all crypto/fiat withdrawals from their website, before the website goes completely dark, followed by them running away with your stolen funds, only to rinse and repeat in the future! This is a typical Ponzi scheme where they "robbed Peter to pay Paul" before robbing both of them and running for the hills with the bag, never to be heard of again.

Now this core principle can play out in different ways. Instead of an attractive girl on a social media platform it might be an endorsement from a community leader or minor celebrity who you trust or it might be a relative or a cousin who has convinced you that they are good at managing money and they can grow yours only if you give them one chance to prove themselves by giving them some of your money to manage. It can also be someone who you came across online who are claiming to be algo trading geniuses and in exchange for a couple hundred bucks they will then sell you their python scripts and very rough codebases that apparently work perfectly in the live market, while secretly installing backdoors, keyloggers and other hidden malware behind the scenes that they will then use to extract out your passwords and private keys over the course of months before attacking you abruptly when you least expect it and have long forgotten about the trading software/codebases that you purchased but lost interest in because they didn't work, to then essentially rob you of everything!

This is why at Magic Money:

- We do not accept or touch your money in any way! Our bots simply plug into your account, and you pay us a subscription fee to extend their license and make sure that they behave as expected.

- We do not try to convince you to trust our "expert" or any other heroic figure/genius who has figured out the market and knows the secrets to the universe due to which they can guide you to the promise land of financial abundance! The certainty of your financial abundance is literally backed by mathematics and code that you can verify, stress test and forward test before getting convinced! Our expertise is in capturing an edge (which is really just a perspective/way of looking at the market) into code. Our strategies are profitable due to probabilities and the use of immutable laws of the market (just like airplanes use the immutable laws of fluid dynamics to take flight). There's no "believe me please" dynamic here, just cold proofs and results that can be validated and verified by the live market.

- We do not sell you any custom scripts or executables that you will have to run on your computer. There is no custom setup or environment required to run our bots. Our scripts are developed on the two most reputable platforms in the industry who are like the Apple and Samsung of the trading world, namely TradingView and NinjaTrader. Most of the scripts that you will receive are meant to be run on Ninjatrader, as such the only requirement will be to setup an account with them, download their software and then upload our bot in their software in order for it to manage the money in your account. Although you will have to transfer your money from your bank account to the Ninjatrader account, they are essentially an accredited, registered and regulated broker who are like a bank in themselves! As such it's unlikely that they will suddenly freeze withdrawals and run away with your money because although I have heard of banks going broke, I have honestly never heard of a broker going broke before since they are essentially positioned as middlemen who shuffle money around within their users and take a small cut for this effort rather than lend their users money out to third parties and charge interest on in with the very real risk of the funds getting stolen or squandered.

2. Why be smart if you can pretend to be smart! (hardcoded trades and very specific conditions that will never repeat)

Although TradingView and Ninjatrader are the two most reputable platforms in the trading world they are essentially extremely complex and large pieces of software built by humans in the pre-AGI era. As such although they are amazing, they are not perfect, and all the scams covered henceforth will be scams specific to hacking these two platforms to show convincing but unrealistic/fake results.

The first and easiest (low IQ) way to game these two platforms to show convincing results is by simply hardcoding the trades instead of implementing any complex logic! This scam usually involves a very desperate individual not coding any intelligence or specific logic into the strategy scripts but instead just creating a very specific list of trades consisting of an entry price, exit price and date-time. The strategy then checks for the date-time match during the backtest to enter and exit these bespoke trades, which then leads to beautiful charts and amazing results. They then show you these results in order to convince you that it works and to therefore part with your money. Then when no trades get placed in the live market, they simply tell you to wait longer so that they can buy enough time for you to lose interest while they figure out a way to vanish off the face of the planet with your money!

A bit more sophisticated (higher IQ) variant of this scam involves someone taking a strategy that's not really profitable and then they try to make it profitable by over-coding it, which then results in such tight and specific rules for the strategy that although it looks genuine and amazing in the backtester it will completely breakdown if you load it up on other markets or deploy it to the live market because of the unlikeliness of its rules ever repeating again in the future.

This is why at Magic Money:

- We create strategies that are actually intelligent and perform well across asset classes despite being finetuned to perform extremely well for a very specific market. You can easily check to see that the trades are not hardcoded or overengineered by loading up our strategies on different markets and in different intervals and ranges to see that the trades are following some kind of logic and are not just clustered around a specific setup.

- We give you immediate access to a community of other users who have also purchased the same strategy as you in addition to gaining access to a broader community of users who have bought at least one strategy with us. This is the antithesis of scamming which requires isolating a victim and defining their frame/worldview so as to convince them of something that's not true and then rushing them into making a decision without any second opinion or fresh perspective on the topic, both of which could easily disenchant them out of the tunnel vision that you are trying to trap them within and both of them are easily available in abundance within our community Discord post purchase!

3. Too high for comfort too low to care! (unrealistic high/low trade exits to game the backtester)

With the most basic scams around fake platforms, fake screenshots and fake results covered let's now dive into the more sophisticated ones that actually requires expertise, intelligence and a level of cunning that very few of the midwits discussed in the previous points who make a living by taking advantage of people's kind and trusting nature even possess! As I mentioned before, platforms like TradingView and Ninjatrader are great, but they are not perfect, so let's dive into a classic scam bot that takes advantage of a very sneaky exploit within TradingView's backtester.

Consider the strategy depicted by the graph below. This strategy trades on the daily candle of the BTCUSDT perpetual contract and over the course of almost 7 years has managed to turn $100 into $6.6k to basically give you a 6,622.54% return on your capital! Moreover, it has achieved this with a 95.18% accuracy and a max drawdown of just 0.87%!!

This sounds impressive right!? But wait, it gets even better, not only has it managed to give you 6 times more money than what you would have made had you held Bitcoin from 2019 and rode the wave of its recent pump, it has managed to do this while giving you consistent monthly recurring revenue and has not had a single losing month ever since the start of its backtesting data on TradingView!! All of this sounds super impressive and honestly if you didn't have a "shut up and take my money" moment while reading this you would probably be lying.

However, as they say, the devil is in the details. As you ride your wave of euphoria for having come across the perfect money printer something interesting happens when you try to zoom in to view the trades on the chart. All of a sudden you start to see a pattern with the trades which might explain the strategies spectacular performance!

If you look at the above chart closely you will see that the strategy enters during the close of a candle and then immediately exits the trade at the highest price of the next candle. If you look at the last green candle you see an exit for a trade that was entered in the previous candle, then in the previous candle you see the entry for the current green one as well as an exit for the candle before that and so on. This exit at the highest value of the next candle is impossible to execute in the live market!! This is because when you are trading in the live market price is always jumping to a high value and then returning back to a low value only to jump back up to a higher value or a lower value to then create the price range that results in the Open, High, Low & Close prices that make up the candle. However, it is impossible to predict which of these "price jumps" will be the highest value for the candle or which one will be the lowest value for the candle while the candle is still open and actively being formed! As such this strategy is essentially assuming knowledge of a criteria that is impossible to guess in the real world as it will require looking into the future and knowing in advance which price jump of the current candle will be the highest or the lowest price for this specific candle, while the candle is still open, which is impossible!

Above you can see the graph for another strategy which uses this exploit. In theory the strategy looks perfect as it promises to generate you 3,548.16% returns over the span of a few years with a 98.68% overall accuracy! When you load up this strategy on the chart it also loads up a bunch of additional vertical and horizontal boxes to depict fair value gaps and time zones respectively to give you the illusion of a very sophisticated underlying logic that might be driving the behavior of the bot.

However, when you zoom in, as you can see in the above image, the scam then starts to become clearer. Not only have they coded the bot in such a way that the Take Profits end up becoming the highest or lowest values of the candle, but the Stop Loss is also coded in such a way that when the strategy loses it actually wins because the stoploss gets inverted into a take profit to again close the candle at its most extreme high or low price! If there wasn't any filter in place to select only a few candles based on some underlying logic, like fair value gap cross over, the profits from this strategy become so huge that the numbers literally break TradingViews backtester and lead to overflow errors!

Above is another example of this exploit where the scammer uses a Trail Stop to try and lock in profits when the position is winning. This is a noble intention indeed, but when processed by the backtester this trail turns into a Take Profit that is again executed at the extreme high or low of the candle!

This is why at Magic Money:

- We always use the Close price of the candle for our trade executions. Each of our strategies has a TradingView version that you can view as a published script (linked in the product descriptions), to verify this fact by looking at its List of trades under Strategy report section. We even showcase the execution timestamps and prices in the screenshots used in our product images. Sure, we use hype marketing terms like "92% win rate" or "no losing month for almost a decade" or "no losing year for the entirety of its backtesting data" but in our case this is actually true and not the result of some hidden exploit! Infact, if you think that working with just the close price is still too perfect because placing market orders for your entries and exits is usually followed by some slippage, we actually account for that as well and have conducted our tests with a good margin of error around the close prices to still remain profitable.

- We only use TradingView to come up with the core algorithms for the strategies and to make them look visually appealing, the deployment ready versions are always exported in Ninjatrader. What this allows us to do is to firstly implement very sophisticated risk and order management systems, such as limit orders, stop market orders, trail stops, break even stops... which are impossible to do in TradingView but secondly these strategies can then be vetted using the Playback feature in Ninjatrader which simulates the exact behavior of the live market. Sure, TradingView has a replay feature as well but it's nowhere near Ninjatraders Playback mode when it comes to sophistication and accuracy! All of the above scam strategies that were mentioned in this point would have been easily exposed and destroyed during playback testing. However, we actively welcome this stress testing for Magic Money strategies. Each one of our strategies goes through a rigorous verification process that spans the backtester, playback, simulated trading and live market trading. Infact the first thing we encourage you to do right after purchasing and activating our product is to test it out and be satisfied that it does indeed work as advertised before trusting it with your real hard-earned money.

4. Hide your crimes in the candles! (bespoke candles and altered data to produce perfect trades)

Having covered a major exploit in Trading Views backtester, lets now turn our attention to an exploit within Ninjatraders backtester which is equally bad if not worse when it comes to producing unrealistic results. To better understand this let's consider a simple trading strategy that could easily be called the worst trading strategy to have ever been invented! The strategy involves placing a long trade on the close of a green candle and a short trade on the close of a red candle. Thats it! Thats the entire strategy and the following chart tries to showcase what it would look like when deployed to the live market.

As you can clearly see in the above screenshot the strategy is pure chaos with multiple mindless entries and exits polluting the entire chart as it essentially overtrades your account into extinction. Below you can see how over the span of just 5 years it would have lost you $7.6M against just 1 NQ futures contract as a result of overtrading (and yes you will still get this horrible result even if you switched the longs with the shorts to mirror trade this strategy).

Below you can also see the beautiful equity curve that results from this strategy! There's literally no redeeming moment in its entire trading history where the account balance maybe bounces back from the consistent losses with some major or minor wins, it's just a straight up nosedive into losing more and more of your money the longer you run this strategy in your account.

However, let's do something different now. If you look at the Data Series section in the right of the above screenshot you will see that the Type is set to Minute, i.e. it is using the standard Open High Low Close (OHLC) candles that naturally result from taking a structured snapshot of the price during specific intervals as it bounces between various price levels. Now let's try turning this input from Minute to Heikin Ashi while maintaining the same strategy logic. The below screenshot captures how this change affects the trade executions that get registered in the backtester.

Although the chart is still noisy you can start to see some clear trends in terms of consistent red and green candles appearing in a clear sequence that's supposed to filter out a lot of noise and capture a clear market trend. As such you should also be able to clearly see some huge profitable trades that result from this strategy clearly riding these structured market waves by riding the structured candle sequences. However, the most interesting part is yet to come.

If you then look at the strategy summary you are hit by a spectacular jump in your results! The strategy went from losing $7.6M to making over $92M in just a span of 5 years and that too with just one contract!! All while giving you an average cashflow of $1.4M/m and a win rate of 60%!

It then gets even better when you look at the equity curve because not only is it a smooth and rising one without any major losses, but the strategy also appears to not have had a single losing day! Moreover, each day it seems to be bringing in somewhere between 4-5 figures of pure spendable income into your account! If you thought that the "shut up and take my money" moment of the previous point was great this basically dwarfs it in every single way. But wait, it gets even better! What if we now switch to an even more complex data series type called ninZaRenko that's not even available in the standard Ninjatrader repertoire but needs to be purchased and imported separately from a third-party vendor. The chart, and therefore the trades start to look even cleaner.

As you can clearly see, this candle type takes the trend filtering of Heikin Ashi to a whole new level using a modified version of Renko candles. The trends appear to be a lot clearer, the chart a lot less messy and the trades appear to be a lot more profitable and consistent with their profitability!

If you now look at the strategy summary, it's nothing short of a miracle! You went from losing $7.6M to now making over $135M in just the span of 5 years with just 1 contract!! Moreover, your win rate has now jumped to 78.74% and your average monthly income is around $5.5M/m!

Then when you look at the equity curve it's like God itself wrote this strategy for us mere mortals! Not only is it perfectly rising without any major losses or setbacks, but it also seems to not have had a single losing day and what's more is that it seems to be bringing in 5-6 figure of pure spendable income into your account with just 1 contract every single day, now image the results with 10 or 100 contracts!

However, as they say, if it's too good to be true it probably isn't (unless its Magic Money 😉)! Although Ninjatraders backtester can be hacked in this way, fortunately when you load up the strategy with the Heikin Ashi or the ninZaRenko candle type into Playback these fake results get easily debunked and exposed! In reality, these perfect entries and trends that get captured by these special candle types in the backtester are an illusion.

Although I have nothing against these two candle types when used during manual trading, because they use genuine formulas that operate on the OHLC values of the standard candles to filter out a lot of the noise, and although some of my own strategies in Ninjatrader perform better when loaded up on charts with these special candles, in terms of gaming the backtester any strategy that shows you results or screenshots using special candles for their data type should be immediately discredited! This is because the values of these special candles are calculated after the underlying OHLC values for the underlying candles have already been set after candle close, however the backtester assumes that the OHLC values for these special candles get calculated in the same way as those for the standard ones! As a consequence of this, the backtester operates on these trades with a future bias whereby it already knows what these candle trends and price levels will be before they have actually been finalized in the live market. Moreover, any complex logic derived from the simple logic of entering longs on green and shorts on red candles will simply be filtering out the trades to enter on very specific candles and exit on very specific candles, to essentially create a subset of this simple strategy, which will again fall under the same bias but might show you more tame and believable results in order to then scam you out of your money!

This is why at Magic Money:

- We only deal with the standard OHLC candles when developing and testing out our strategies. Moreover, these tests are not conducted just in Ninjatrader but are done across both Ninjatrader and TradingView and that too across different data providers to ensure beyond a shadow of doubt that our strategies are platform and data provider agnostic. This agnosticism therefore ensures a real, genuine and profitable edge that can consistently/certainly beat the market and make you money so that we can indeed deliver on our promises to you.

- As mentioned in the previous point, all of our strategies go through rigorous backwards and forwards testing across the backtester, playback, simulation and live market on not just Ninjatrader but also Tradingview, and across different data providers. This rigor therefore creates multiple breaking points and filters which are meant to expose any hidden glitches or flaws in the strategies that might be resulting from a bug or miscalculation across these frameworks. Moreover, since we are a verified vendor for the Ninjatrader ecosystem, all of our strategy files undergo a thorough Quality Assurance testing by the official Ninjatrader team before they get listed in the ecosystem. If that still wasn't enough, I have created custom code within my strategies to prevent Instance Abuse attacks, where you load up the strategy on multiple charts while just purchasing one license, due to which I have had to go through QA testing not once but twice before creating the final exports that I have secured via military grade double layer encryption to make sure that our secret sauce remains hidden and is not hacked/open sourced in the future to further dilute your profitability by diluting its edge as a consequence of Efficient Market Hypothesis kicking into full gear and the edge getting priced into the value of the underlying asset because everyone now knows about it and is actively trying to use it to make money for themselves!

5. To close for comfort! (narrow trade entries and exits within a continuous ticker tape assumption)

One of my favorite moments from the Game of Thrones series is this encounter where the queen is talking to one of the wealthiest nobles in her realm and as their conversation progresses, he tells here the trite proverb that "knowledge is power". She then abruptly tells her guards to seize him, then she instructs them to cut his throat and then at the very last minute she tells them to stop because she has changed her mind, following which she tells him a powerful truth that power is power.

Life is often like this. You can be the most ideal and qualified candidate for a job or a romantic relationship and in the very last minute someone out of the blue will come over and swoop her away from you or undo all of your hard work to seize your opportunity for themselves or worse still, downright steal your invention/discovery and claim it as their own or file a patent on it before you (since you were clearly unable to afford one) to get rich off your back without even trying! You can literally spend years learning, training, planning and preparing to be the best in the world at something but when the rubber hits the road someone else might show up out of the blue and easily defeat you while taking down everything that you stand for not because they out prepared you but because they outcompeted you using their sheer reaction in the heat of the moment. The market is no different.

You might have done all of your due diligence and then gone through deep and rigorous testing to make sure that you have a real edge and that all systems are working as expected to basically have come up with a strategy that's guaranteed to make you money, only to then be met with some nasty surprises around your orders not getting filled, or your connection dropping unexpectedly due to which you missed a super profitable trade or your data feed wasn't even connected to the live market because you forgot to reset it over the weekend or the worst one yet, you weren't able to get the price at which your strategies signal was triggered leading to you not making as much money as you had expected to make only to then come to the solemn realization that the strategy does not work in the live market in its current configuration and in some cases the realization that the strategy does not work at all!

This kind of scams are not all that obvious at the start and not obvious at all unless you have some skin in the game and have tried things out in the live market for yourself. It would also be wrong to call it a scam because someone might engineer a profitable strategy that they believe is genuine and which they then try to share with you with the purest of intentions, only to be completely unfamiliar or unaware about how things actually work in the execution layer due to which they are then met with some nasty surprises. For example, consider the strategy depicted by the graph below which trades on the BTCUSD futures contract on the 1min interval.

At first the graph looks amazing! It's a steady and rising equity curve with no major fluctuations or drawdowns. Then when you zoom into the trades you can see that it makes $20-$40 of profit every single day against 1 contract consistently over the course of the past 5 years of backtesting data.

It then promises you an average monthly return of around $1k and around $67k in profits over 5 years which is not bad at all especially considering that the most you lose during each trade on average is $0.04, which is way below the entry fees anyways!

However, the devil again lies in the details. If you now open up the chart and zoom into the candles to observe the trades under a microscope, a clear pattern seems to emerge with them. If you look closely at the above chart, you will observe that the profit target and the stoploss are super close to the entry price.

At one level this approach might make sense right? Instead of taking a big chunk out of the market with the risk of drawdowns and losses why not take small bites, where the profit of one trade makes up for the losses of at least two trades, and then let chaos work its magic as eventually the tiny profits add up to create the large market beating returns and stable cashflow. What could possibly go wrong?

Well, it turns out that there are many such examples as the above strategy within the Ninjatrader ecosystem whereby they show beautiful equity curves and follow this logic of micro profits eventually building up to the macro results, however the underlying assumption behind all of them is that "price" aka the ticker tape is continuous and not discrete, i.e. they assume that price moves up or down in a clean manner going over every single price point and that too linearly. For example, if the current price is 19000.00 and the tick size is 0.25 then the assumption is that before the price goes up to 19100.00 or below to 18900.00 it will go over all of the values in the middle, i.e. 19000.25, 19000.50... 19099.75, 19100.00 or the other way around however in reality it does not work that way. Price might be at 19000.00 now but it might then directly jump up to 19058.25 or directly below to 18987.50, bypassing all of the values in the middle because that's the level at which those with liquidity decided to place their orders or the level where the opposite order for what you want (i.e. a buyer or seller) exists. As such if you have a strategy such as the above one with a very narrow profit/loss margin, chances are high that it will get completely obliterated in the live market due to the "jumpy" nature of price. As such if you place a limit or stop market order to secure a certain price level, price might just jump above or below this order without even hitting that level and your Ninjatrader instance will be filled with multiple error messages as your strategy completely breaks down or gets locked into a losing position that continues to get dragged into the opposite direction of your trade to completely liquidate your account, all while you sleep like a baby, blissfully unaware of carnage that's going on with the capital in your account!

This is why at Magic Money:

- We have built-in fallback mechanisms within our strategy code that can handle a complete breakdown of limit/stop orders due to the jumpy nature of price without crashing your account or locking you into a losing position that can liquidate your account, all while still giving you a decent exit for that problematic trade. Moreover, we don't deal with micro-orders like the one depicted above, our smallest orders have their exits at least 20 ticks away from their entries to create a comfortable enough cushion to handle rapid price fluctuations and slippage. Also, we have partnered up with VPS providers who have their servers positioned 0.001s away from the CME exchange server (where these trades get sent for execution) and are communicating with it using a stable internet connection with speeds of over 100 GB/s to give you the best possible entries and exits! Moreover, we also hold weekend check-in sessions with all of the members of our community to make sure their servers/instances are updated and that everything is running properly before the market open on Mondays, in addition to also checking in on them as individuals to make sure that they are in peak mental and physical health while also being on track to achieving their larger life goals now that money is starting to become less of a concern for them.

- We also try to extend the longevity and certainty of our strategies by breaking them down into only 4 tiers and capping the sale of each tier at 100 units. So, in case we have a full sellout for a strategy and fill up all 400 spots, our community would then be responsible for trading a maximum of 8,600 contracts for its underlying instrument as a whole. Given that we mostly trade NQ on the 1hr timeframe, and that the average daily trading volume of NQ is around 639,287 contracts, which comes to around an average volume of 26,637 contracts per candle on the hourly chart, even if our entire community ends up placing the same entries and exits at the same time it will only average out to around 32% of the average trading volume which almost guarantees liquidity and perfect fills. What's more is that this order volume, when coming from multiple accounts, might actually end up moving the market ever so slightly in our favor leading to slightly more profitable exits as a community due to reflexivity than if we sold just a few units and therefore operated with a fewer number of contracts. Besides 32% of an average single candle volume is the perfect sweet spot where we can preserve the strategies edge while not "killing the golden goose" (metaphorically speaking) because instead of taking profits from other traders we end up taking profits from each other, leading to shrinking profit margins and a nasty race to the bottom as the edge starts to get factored into the price!

6. Better to buy bigger clothes than to get in shape! (overfitting to the data instead of creating sentient data processing systems)

While developing trading algorithms it's very easy to fall into the trap of mindlessly trying out a bunch of indicators, techniques and approaches to eventually figure out something that works, to essentially brute force your way into building a profitable trading algorithm. This approach is like picking up a shovel and mindlessly digging in the general direction/area where there might be gold! Sure, many a times this is better than doing nothing and you might strike it big with the discovery of a very profitable edge which you then use to get yourself and those around you extremely rich. But what happens if the goldmine suddenly dries up or instead of gold you start extracting out some other metal? Do you take off your diamond encrusted suit, leave the comfort of your gilded mansion and start digging in the dirt again because that's the only way you know how to discover more gold? Also, what if the substance that you extracted wasn't gold at all but some other metal that looks like gold?

This is the problem with a lot of trading algorithms, especially the machine learning ones, where they were essentially brute forced into existence and celebrated because they molded themselves perfectly to fit their respective datasets, due to which even if they followed the correct protocol and got all of the previous 5 steps correct to be on par with our rigor and due diligence, they might still malfunction and behave differently in the live market to produce results that are completely different from what they showed you in the backtester or even in playback! Also, this overfitting due to mindlessly trying to get them to excel within a certain dataset to make them appear to be more profitable than what they really are is a godsent recipe for scammers who use these skewed results and screenshots to brag about how the strategy made them 40,000% returns in just 3 years while threatening to show you "proof" if you dare question their authenticity or excellence.

This is why at Magic Money:

- We take a zeroth and first principles approach to building our algorithms. Instead of taking a shovel and mindlessly digging in the direction of the gold we first take a sonar and x-ray scanner to map out the entire area to create a 3D rendering of the underground terrain. Then once we have isolated the goldmine, we create sophisticated robots that create tube-shaped holes to extract out the gold without even altering the terrain or ecosystems surrounding the excavation site. Of course, this is a metaphor that expands on our previous analogy but this manner or thinking underlies our approach to strategy development. We firstly start off with dealing with general and immutable laws of the market just as an aerospace engineer would deal with the immutable laws of nature. For example, one of the immutable laws of aerodynamics is that air moves from an area of high pressure to an area of low pressure. This simple principle can then be used to come up with the concept of buoyancy and lift whereby the wings get designed in a manner where they are curved on the top and flatter at the bottom which makes air move faster at the top, which creates low pressure, than at the bottom, which creates high pressure, all while outsourcing the heavy lifting (pun intended) to God/nature/the universe! The markets work in the same way, one of the immutable laws of the market is that price moves from an area of high liquidity to an area of low liquidity. This simple principle can then be used to come up with the concept of exhaustion and reversals whereby our bots can then be designed in a manner to easily catch emerging trends and get out of "turbulent weather" before getting caught up in a hurricane (which is why SublimeMRR has not had a single losing year in their entirety of its backtesting history which has of course been validated with a perfect sync up with live market trades for authenticity).

- We only try to brute force our optimizations after we have finished creating our strategies based on first principles/immutable market laws in order to get them to properly track the behavior of the underlying demographic that makes up the specific market that they will be deployed to. This is because although there are general immutable market laws that govern all markets, each market is unique in its own way and is made up of a unique demographic on the other side of the screen. So just as you need different types of aircrafts for different missions you need to finetune your underlying strategy for different markets, in which case we use a shifting window approach to make sure that our optimizations don't overfit to the data by making sure that the optimized version performs well within random time ranges/snapshots of the market with its globally optimized settings. Moreover, once we have built our strategies based on first principles and optimized them for a specific market/demographic, our final cherry on top is in executing our trades under a high probability setup which adds an additional security net of statistics in addition to immutable market laws to make sure that they are profitable and continue to generate money for you consistently!

7. Two years is a long time! (overfitting to present market conditions but breaking down during deep backtesting)

We as a species have come a long way in the past 200 years. From landing a man on the moon, to finding a cure for most diseases, to the birth of the internet, social media, AI and tools such as CRISPR to now being able to detect gravity waves and peer into the atmosphere of planets that are hundreds of light years away. Our understanding of ourselves, the world around us, our role in it, has all changed dramatically and is now continuing to accelerate at an astonishing pace! The lifestyle of an average human being in 2025 is better than that of most kings and queens just a couple of hundred years ago. The invention of birth control, women's rights, minority rights, equal rights in the workforce and equal opportunities to contribute on a global scale thanks to the internet are things that would have been considered pipe dreams and amusing fantasies for most of human history. Amidst all of this technological progress empires have come and gone, world orders have changed, textbooks have been rewritten multiple times, powerful and influential people have come and gone, and yet somehow, despite all of these tectonic changes, the words, beliefs and worldviews of individuals who existed during a time where most couldn't even read or write, proper sanitation was nonexistent and the life expectancy at birth was 25-35 years have not just survived into the modern era but are still being recited, taught, heavily defended and followed by billions of people! Why?

Why have all aspects of the human experience changed in these past two centuries except for religion? Why hasn't a new major world religion emerged yet that is in tune with the needs of the modern world and our genuinely enlightened understanding of the world around us as well as our place within it as a consequence of the rapid scientific advancements that we have witnessed in just four generations?

As a consequence of engineering Cosmism, my own religion, the answer became clear to me. If science tells you how the world works, then religion tells you how to be in the world, while Cosmism tries to bridge the gap between the two by helping you best be in the world based on how the world really works (which includes a newfound understanding of the prior and the after life based on a new Theory of Everything called Qualia Spaces). In the process it became clear to me that the reason why religion has survived for so long without being disrupted is because the problem of being that it addresses is just as pressing for us modern humans today as it was for our ancestors who were alive during the times of these sages and prophets.

Somehow the patterns of consciousness that emerge within our minds today are the same as the patterns of consciousness that emerged within the minds of our ancestors a couple of centuries and millennia ago. As a result, the social dynamics, existential dread, emotional whirlwinds and action-reaction sequences that these repeating patterns of consciousness give rise to within the framework of our human being in the modern world are also similar if not the exact same as those encountered by our ancestors during their human experience. As such, when we try to process this experience of life that emerges from this underlying complexity of our external environment, social fabric and inner worlds, we instinctively turn to the same balm as them and try to find our solace in the wisdom, stories and fantasies that helped them weather these storms, thereby acting out similar if not the same reaction patterns/behaviors as them despite our environment, worldview, knowledge, understanding and agency in life being completely different to theirs, and in the process we end up keeping their religion alive!

Now this tendency to approach repeating patterns of consciousness in the same way as those who came before us is not limited to religion. Infact it's not even limited to a single individual and can easily be extended to groups! When people come together to form groups, the group becomes a new super-organism with a mind of its own. As such, the repeating patterns of consciousness of this emergent/hive mind then become the repeating patters of consciousness that are consistent across the minds of all of its underlying members. Then when this group of individuals bump into the same problems and patterns as the groups who came before them, they will navigate it in the exact same way as an individual would, leading to similar results as an individual but on the level of the group, which then results in the observation/saying that "history often repeats itself" (and when it doesn't it most definitely rhymes!).

In the stock market, the hivemind that emerges out of all market participants has its own repeating mental patterns as well. Moreover, these repeating mental patterns give rise to mood swings and repeating behaviors within this super-organism that we call "the market". These mood swings create the oscillation in price of an asset (or the market as a whole) from a low to high and then back into a low again which is formally referred to as a market cycle. Also just like the scriptures and verses in religious text, some people have tried to capture this mental pattern of the hivemind in a manner that's memorable but instead of stories they chose charts and graphs like the one below:

Also, just like scripture, it wouldn't be all that useful or relevant enough to be passed down via generations (years) unless it provided you with a solution that helped you better navigate through the problem of being in the real world/arena of the live market. Below you can see how the pattern captured in the cheat sheet above played out almost identically in the live market of BTC/USD on the daily candle:

With that said a typical market cycle takes between 8-12 years. Since the dot com crash in early 2000 the NQ futures market has had 4 major macro market cycles, namely:

- The 2000-2008 cycle (8 years)

- The 2008-2020 cycle (12 years)

- The 2020-2022 cycle (2 years)

- The 2022-present cycle (3+ years)

As you can see these cycles are not as clean and certain as you would expect them to be (but they definitely rhyme!). Moreover, these macro cycles have a lot of micro cycles hidden within them, all of which follow a fractal pattern of booms and busts, where what happens on the smaller scale is similar if not identical to what happens on a larger scale and vice versa.

So, with this thorough groundwork around repeating consciousness patterns, hiveminds and market cycles in place, lets now explore the question of the ideal time range to backtest a trading strategy for it to be considered valid.

During my time in the trenches, I have come across strategies that look amazing in the backtester and the results are even in sync with playback, simulation and the live market but when you look closely you will see that the strategy was hyper optimized for the past 2-3 years! As such most of the results might as well have been luck due to the unexpected stock and crypto market rally's due to Covid. This becomes clearer when you extend the backtesting window to the 10–20-year range and the strategy completely breaks down as its recency bias gets exposed as you witness the chart being mostly in the red for years and then suddenly spiking post 2020 due to the unprecedented money printing followed by its subsequent injection into the markets that took place during this period. For example, consider the following strategy:

From a quick glance it might appear to be a profitable strategy with a steadily rising equity curve. It might also seem legit because the backtesting results are in sync with the playback results and it's not using any special candles or sneaky exit logic. However, as soon as you put it through the filter of a deep backtest the scam becomes obvious:

As you can clearly see this strategy completely breaks down over a deep time horizon because it was biased to recent market conditions and only managed to capture a fraction of the mental patters of the hive mind that makes up its underlying NQ market. As such, if you made the mistake of buying this bot you would have been in for a nasty surprise because right after its success in 2022 the strategy started misbehaving and lost a lot of money in the subsequent years as it failed to adapt to the current market cycle that we are in right now following the crash of 2022:

This is why at Magic Money:

- We have a minimum backtesting threshold of 8 years for a strategy to be considered valid. This is why all of our product backtesting screenshots showcase a minimum of 8 years rather than 5 or 10 of performance. Moreover, since these market cycles are inherently unpredictable in terms of their start and end times, we focus more on capturing/identifying the patterns of consciousness of the hivemind that make up a market cycle (which as we mentioned earlier are somewhat predictable) than on timing the market, tracking sentiment/news/influencers or simply going with the flow.

- We tend to avoid lower timeframes (with rare exceptions) in order to be able to capture more signals than noise from the market. As mentioned in the previous point our strategies are firstly grounded using the immutable laws of the market and statics before undergoing brute force optimizations for their specific markets that they will eventually be deployed to. As such the laws of the market, like the laws of the natural world, follow this property called Emergence whereby they are very unpredictable and chaotic on a smaller scale (think an electron being in two places at the same time) but become very predictable and smooth the more we zoom out (think landing a rover on mars using the laws of relativity). Moreover, statistical phenomena also have their equivalent of emergence called the The law of large numbers whereby events that appear to be chaotic when looked at an individual/case-by-case basis tend to give rise to a larger and more predictable expected behavior the more we increase the sample size (zoom out). Since we are in the business of capturing and predicting perspectives and emerging consciousness patterns from within a hive mind, it makes sense to use these two meta laws to our advantage to make our products more stable and predictable with their returns regardless of the time horizons and market conditions that they find themselves within when you first start them, all while making sure that they can indeed withstand the test of time across decades if not centuries.

8. "We tend not to have things like Stop..Losses.. I think those are not necessarily great risk management tools" (no built-in safety mechanisms, risk management or infinite drawdown protections)

The above quote belongs to Caroline Ellison, the CEO of Alameda Research, that was a crypto trading firm and a sister company to FTX, a crypto trading exchange that was the brainchild of Sam Bankman-Fried. She was also involved in a romantic relationship with Sam. Her genius approach led to the firm losing billions of dollars in capital, which was mostly borrowed money from various banks, and as the losses piled up to become unbearable the firm started to get margin calls where these lenders now wanted their money back, which then put Alameda on death row and on the verge of bankruptcy.

The Bible has a famous verse in Proverbs 31:3 which reads, "Do not give your strength to women, nor your ways to that which destroys kings.", which might sound patriarchal and archaic in the modern world, but the underlying message is true. Maybe it was love, maybe it was greed, maybe it was the need to uphold a spotless reputation, whatever the motivation was we will never know for sure but to protect Alameda Research, Sam ended up issuing billions of dollars of FTT tokens out of thin air and then gave it as a gift to Alameda, which Caroline then used as collateral to take out loans from FTX whereby she "borrowed" billions of dollars in user funds to pay off her debtors and save her firm!

Then as rival firms like Binance, who were holding a lot of FTT token, began to notice this surplus in the market and the huge holding of FTT tokens within Alamedas books they immediately started to unload their positions, which then lead to a crash in the price of FTT, essentially making Alameda's collateral worthless! Rumors then start to spread of what exactly had happened behind the scenes which then sparked fears and lead to massive withdrawals of funds from FTX, which eventually exhausted their remaining reserves and led to them filing for bankruptcy as they were completely unable to pay back their customers because of the mismanagement of their funds, leading to the billions of dollars in Alamedas losses now being realized by ordinary users who have probably never even heard of Caroline Ellison and only trusted Sam Bankman-Fried. What's more is that all of the anger and hatred of the entire world was now being directed towards Sam and FTX because they were unable to pay back hundreds of thousands of users and not the person who was responsible for this fiasco in the first place! Then as Sam lay in the ruins of his former empire, hated and hunted by all, the final twist of the dagger in his heart came when Caroline Ellison was willing to testify against him in detail for the FTX scandal in order to bring down her own prison sentence to a mere 2-years while condemning Sam to 25 years in one of the worst prisons in the US and thousands of other users to empty hopes, financial ruin and shattered dreams. Thats the danger of not trading with a stoploss and allowing your emotions to get the best of you!

At one level I understand the temptation of not wanting to use stop losses or risk management. One of the most painful experiences in trading is realizing a loss only to then have the market move in the direction of your original trade, leaving you with a hole in your account and a mind that's filled with regret for having closed the position too early. Moreover, our current economic paradigm is designed in such a way that the claim on money will always be greater than the total money in existence. What this means in simple words is that when they print money out of thin air, they justify the act by essentially "borrowing from their future selves" as a nation, i.e. just like an individual can justify borrowing money with the agreement of paying it back with interest on a future date because they believe that their income will go up in the future to allow for that repayment, nation states borrow from themselves in the form of printing money out on thin air in hopes that their GDP will increase in the future to be able to pay it all back with interest! Then when the future finally arrives this pattern would have already propagated itself into a new future to therefore always ensure that the total claim on money always remains more than the money that exists in the world while also condemning everyone in the world to perpetual productivity and labor in pursuit of whatever scraps they can accumulate over their entire lifetime just to survive and maybe taste a bit of the pleasures that come with this human existence. What this also means is that by designed, the markets will always go up no matter what! Even if there are recessions, crashes, temporary drawdowns or even downright depressions, as long as our current economic paradigms will exist, the markets will always go up. So why sell at all? Why not just develop diamonds hands to weather the pain of the drawdowns and then eventually emerge rich someday, only to not realize those gains and repeat the cycle again until you are dead or bankrupt, with other people cleaning up your mess!?

Well the simple answer is that we can't afford to do that and the real answer from the author of this article is that doing so is ugly, unintelligent and not aesthetically pleasing or beautiful, let alone dangerous for those who cannot afford to print money out of thin air and are therefore forced to survive by taking it from other people in exchange for a valuable/meaningful contribution to their lives than from future generations without their consent due to an inability to properly address and manage the financial needs of the present generation who put you in your position of power.

This is why at Magic Money:

- We take risk management very seriously. Each of our strategies are shipped with a built in Take Profit and Stop Loss that's hardcoded into their source code. Moreover, we take a multidimensional approach to risk management where in addition to the built-in TP & SL our strategies ship with daily/monthly/weekly/yearly (depending on the strategy) profit and loss quotas which creates an additional layer of protection around them. Then if that wasn't enough our most premium strategies ship with a third layer of risk management that sets dollar profit and loss targets for each entry via limit/stop orders to further protect your capital and improve your probability of securing a profit on the trade. This multidimensional approach alone boosts the value of our edge significantly and is based on custom code that we have developed over years - that also creates a mote around our strategies which makes them extremely hard to replicate by those who are planning to sell similar products to ours. In addition to this core layered risk management, we also have many other proprietary risk management systems that we have developed over the years that cannot be found anywhere else which adds in additional depth and layers to the multidimensional risk management that's already enveloping the edges that are at the heart of each of our strategies/bots.

- We also take drawdown protection very seriously. Ninjatrader recommends having a minimum of $1000 in your account for each contract to trade futures but from experience this is not always a good idea. Having been in the field and blown up a few accounts ourselves we have learnt the very painful lesson that more than the strategy the margin that you put in your account as risk capital is the most important factor when it comes to preventing an account blowup via a sudden rapid price fluctuation that can make you lose everything! As such, the risk capital that we recommend for each strategy has been selected as a consequence of rigorous and thorough backtesting in order to drastically lower the probability of an account blowup happening. Moreover, we have even had instances where Ninjatrader as a software completely malfunctioned and locked us into losing positions which blew up the account, due to which from the very beginning we help you setup your instance whereby you can exit/cancel the trade from an external third-party software in the rare occasion where Ninjatrader might malfunction. Also, we have been extremely thorough and tried our level best to ensure that our cashflow strategies produce stable and consistent returns without massive trade or account drawdowns. For example, the Sharpie Ratio, which is a standard measure of strategy returns adjusted based on drawdowns, for the SublimeMRR series is 1.07 while its Ulcer Index, which measures the depth and duration of drawdowns (lower value is better) is 0.01. Just to give you some perspective the Ulcer Index for the S&P 500 index typically ranges between 3-8 while its Sharpie Ratio ranges between 0.4-0.6, for a typical Hedge Fund the Ulcer index is between 1-3 while the Sharpie ratio is between 0.5-0.8, while for Warren Buffet himself the Ulcer index for Berkshire Hathway is around 2 while its Sharpie ratio is around 0.76! So, you are literally buying access to the top tier industry talent when it comes to trading and money management when you subscribe to any one of our strategies/bots, with the additional benefit of this access being fully autonomous and unburdened of a lot of the paperwork, bureaucracy and trust that's involved with these legacy institutions/investors.

- Lastly, we take recovery very seriously. Despite our best efforts we can never guarantee that you will not lose money in the markets or that you will not have a single losing month with our cashflow bots. However, what we can guarantee is that if/when you do, we will try our level best to help you recover from it such that in the long run your equity curve will look like that loss never happened in the first place! These complex recovery mechanisms are again part of our proprietary risk management techniques that have been developed over the course of years and at the cost of our own personal capital. As such, in the worst-case scenario, whatever you lose will always be a temporary loss and if you can stomach the pain of it then there's a glorious future waiting for you on the other side of your initial purchase, and I look forward to meeting you there!

Conclusion:

If you just skimmed over the article to now reach the conclusion, I highly recommend you take in a deep breath, hold it in for three counts, and then exhale it all out, while counting till four and then repeat this cycle three times. I then want you to ponder the question of whether true financial freedom is something that you genuinely want? If so, are you willing to put in at least some effort for it upfront, even if it's just a onetime investment? If the answer is yes, then I want you to block out some time from your busy day, calm down your agitated mind and re-read this article again in detail before making your final decision with the purchase.

If you have read the full article and made it to this paragraph, then congratulations! You now know more about the markets and trading bots than 99% of people in the industry! As such, as a parting note, I want to thank you for your attention and time, and if you do decide to pull the trigger and make your first purchase with us, I look forward to greeting you on the other side, onboarding you personally and then watching your transformation unfold over the course of your partnership with us as we start to unburden you of the pursuit of money as an obstacle towards your ultimate self-actualization and therefore the ultimate actualization of us as a species.

See you on the other side Deus!

Best,

Alan Trudor